Amtrak train rolls through the Midwest

January 21, 2023

The US Rail Manufacturing Supply Chain is Strong

The transit and rail manufacturing supply chain in the United States is strong and has only grown stronger in the years since our last supply chain report in 2015. The bipartisan Infrastructure Investment and Jobs Act has amplified these trends.

The future is bright for passenger rail. The bipartisan Infrastructure Investment and Jobs Act (IIJA) of 2021 launched a new era for American train travel by funding everything from new train sets and track improvements to substantive planning for route expansions. These investments will reverberate throughout the economy, creating rail manufacturing jobs and improving mobility.

A few years ago, the Blue Green Alliance and the Environmental Law & Policy Center explored the passenger and transit rail manufacturing supply chain and found it widespread and important to the U.S. economy. You don’t have to be a regular rider to benefit from the supply chain, which connects Americans across urban, suburban, and rural communities alike. We found 750 companies in at least 39 states manufacturing components for passenger and transit rail. We dug deeper in the Midwest and Mid-Atlantic regions where a vibrant manufacturing network includes hundreds of companies providing major parts, sub-components, materials, track, and repair services as well.

A few years ago, the Blue Green Alliance and the Environmental Law & Policy Center explored the passenger and transit rail manufacturing supply chain and found it widespread and important to the U.S. economy. You don’t have to be a regular rider to benefit from the supply chain, which connects Americans across urban, suburban, and rural communities alike. We found 750 companies in at least 39 states manufacturing components for passenger and transit rail. We dug deeper in the Midwest and Mid-Atlantic regions where a vibrant manufacturing network includes hundreds of companies providing major parts, sub-components, materials, track, and repair services as well.

Every investment in passenger rail and public transit creates ripples throughout the economy. A contract for railcar assembly may be the big story that hits the news, but it sets off a chain of bidding and buying among hundreds of other companies, ranging from steel smelting to fabric design. Feeding into railcar assembly are propulsion components, electronic systems, body, and interiors. Sub-suppliers provide component manufacturers with parts and other inputs, such as steel, plastics, glass, and other materials. Beyond that, there are manufacturers supporting infrastructure, such as stations, tracks, and signaling information systems. Then maintenance, refurbishing, and remanufacturing give new life to existing materials and make the most of initial investments.

This is a growing and dynamic economy, where many new companies have emerged and boomed. Some companies may have shifted, merged, or disappeared since our report in 2015, but the overarching trends are positive, and the industry as a whole is stronger than ever.

Recent Route Growth

Passenger rail and transit ridership have been booming in the 21st century, reversing decades of prior decline. Amtrak carried a record 32.5 million passengers in 2019 and was expecting to have positive earnings for the first time in 2020. Transit ridership soared to 9.75 billion passengers in 2019, with a 6.8% rise in heavy rail ridership from 2010 to 2019, a 10% rise in commuter rail, and 5.1% in light rail. Despite the shocks of the pandemic, transit and passenger rail ridership have rebounded quickly. Ridership is even exceeding pre-covid numbers on Amtrak during the final months of 2023 and year-round on Richmond, Cincinnati, and Tucson transit systems. New investments will only accelerate these trends.

From 2000 to 2023, US active rail transit line length grew 10%. Since our last report, many small and mid-sized cities have built new trams and trains. Even notoriously car-oriented communities have built out substantial transit systems in the past few years. A couple highlights include:

Los Angeles – The Los Angeles County Metropolitan Transportation Authority (Metro) built over 25 miles of new train service since 2015, including the L, K, and E line extensions, not to mention significant bus rapid transit growth. To service the new tracks, Metro purchased 235 light rail cars from Kinki Sharyo Co Ltd, assembled in their Palmdale, CA facility, which began rolling out in 2016. Then in 2017, the agency purchased 64 cars from CRRC Sifang, which built a new facility in LA to build major components for propulsion, heating, ventilation, AC and lighting, before final assembly in Springfield, MA. The first of these train sets rolled out in 2023. Additional subway cars could bring the CRRC contract total to 282 train cars for $647 million in the next few years.

Light rail trains pull into Denver’s Union Station

Denver – Denver’s Regional Transportation District has opened three new commuter rail lines since 2015: the 23.5-mile A Line to the airport (2016), the 6.2-mile B Line to the west (2016), the 11.2-mile G line to the northwest (2019), and the 13-mile N line to the north in 2020. The accompanying train cars were assembled at Hyundai Rotem’s plant in Philadelphia, PA.

Honolulu – Hawaii’s biggest city opened its first transit rail service in 2023, called the Skyline. The initial segment is 10.75 miles of track and 9 stations, in addition to a new rail operations, maintenance, and storage facility. Another 8 miles should open by 2026. Its Hitachi Rail trains are the first automated transit cars in the U.S. Hitachi Rail US is headquartered in Pittsburgh, PA, with signal manufacturing in Batesburg, SC and train manufacturing in Miami, FL and Washington County, MD.

Over the past decade, there has been a rebirth of streetcars and light rail lines that sparked an accompanying manufacturing boom. New systems include:

- Cincinnati, OH – Connector streetcar opened 3.6 miles in 2016. CAF USA, Elmira, NY.

- Charlotte, NC – CityLYNX Gold Line opened in 2015 and expanded to 4 miles in 2021. Blue Line expanded in 2018. Siemens, Sacramento, CA.

- Dallas, TX – Dallas Streetcar is a 2.5-mile line that opened in 2015, and extended in 2016. Brookville Equipment Corporation, Brookville, PA.

- Detroit, MI – Qline 3.3-mile streetcar opened in 2017. Brookville Equipment Corporation, Brookville, PA.

- Houston, TX – METRORail light rail line expanded in 2017. CAF USA, Elmira, NY & Siemens, Sacramento, CA.

- Kansas City, MO – KC Streetcar is a 2.2-mile line that opened in 2016, with an expansion underway that should open in 2025. CAF USA, Elmira, NY

- Milwaukee, WI – The Hop streetcar opened in 2018 and expanded to 2.5 miles in 2023. Brookville Equipment Corporation, Brookville, PA.

- Oklahoma City, OK – Oklahoma City Streetcar opened 4.6 miles in 2018. Brookville Equipment Corporation, Brookville, PA.

- Sacramento, CA – RT Light Rail expanded in 2015. Siemens, Sacramento, CA

- Tempe, AZ – Tempe Streetcar opened a 3-mile line in 2022. Brookville Equipment Corporation, Brookville, PA.

New interior of a Siemens Venture train on the Midwest Hiawatha line

Intercity rail business is on the upswing as well. Amtrak is purchasing Alstom replacements for the Acela train sets for $2.5 billion. For the ambitious Los Angeles-San Francisco electric high-speed rail line, California invested $9.8 billion between 2006 and 2022, with the goal of reducing greenhouse gas emissions equivalent to taking 400,000 cars off the road. And in the South, Brightline has emerged as the first private company to expand passenger rail in decades, rolling out 15 Siemens trainsets in 2017 and another 16 in 2023.

Five more Siemens Venture trainsets are in production now, which could go into service by 2025. This same Siemens line of new cars started rolling onto Midwest routes in 2022, where service improvements include 110mph trains between Chicago-St. Louis in 2023 and a second daily train between Minneapolis-Milwaukee-Chicago launching in 2024.

Companies are Expanding

New 7000 Series CRRC Sifang railcar on Chicago’s Blue Line

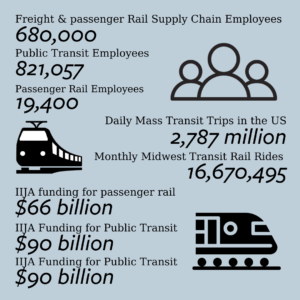

These investments have translated into good jobs for Americans. There are over 680,000 people employed in the rail manufacturing supply chain, in addition to the 800,000+ employees working in public transit operations and nearly 20,000 employees in passenger rail, plus thousands more in construction. Here are a few companies that have benefited from growing investments in transit and passenger rail:

Alstom is the world’s largest global supplier of rail vehicles and has provided over 25% of America’s subway cars. But the company faced challenging times in 2010, when its largest U.S. manufacturing facility in Hornell, NY was down to just 25 employees. Key contracts to build trains for Amtrak and New York city’s Metropolitan Transit Authority turned things around, and the facility has since rebounded to 900+ workers. In 2023, Alstom won a contract to build 500 rail cars for Chicagoland’s Metra, with IIJA funding, so the company is building a new 135,000 square foot facility in Hornell to accommodate.

Siemens Mobility is also seeing big growth in U.S. rail manufacturing. Just this year, the company broke ground on a new $220 million rail manufacturing facility in North Carolina. In 2023, it won contracts to build new transit vehicles for Cleveland, OH and Sacramento, CA, in addition to new Amtrak Airo contracts awarded in 2021 and 2023 that are expected to run on 14 lines by 2026. For just the Airo line, Siemens uses parts manufactured by another 100 suppliers in 31 states, as part of the broader rail manufacturing supply chain. There are 4,500 Siemens Mobility employees in the U.S. today, working at manufacturing sites across the country including the largest facility in Sacramento, California.

Wabtec Corporation manufactures products for nearly every transit system in the world, in addition to freight and passenger rail, based in Pittsburgh, PA. The company purchased GE Transportation in 2019, folding in another century-old locomotive business. Wabtec products include pneumatic, electronic, and mechanical devices such as braking systems, passenger doors, signaling equipment, and air conditioning. Wabtec worked with Carnegie Mellon University to unveil the world’s first battery-electric freight locomotive in 2021, an innovation that could mean cleaner trains in the future. This summer, the growing company announced a $2.7 million investment in expanding its Salem, VA manufacturing facility for pneumatically controlled braking systems.

CAF USA, Inc. is a U.S. subsidiary of Spanish company Construcciones y Auxiliar de Ferrocarriles, which purchased a long-time railcar facility in Elmira, NY in 2000. The company pioneered the first low-floor streetcars in the U.S. for easy boarding and accessibility. CAF has grown into a major U.S. manufacturer, providing light rail vehicles for Maryland, Houston, and Boston; sleeper, diner, and baggage coaches for Amtrak; and streetcars for Kansas City and Cincinnati. The Elmira facility grew to 400,000 square feet by 2016 and added another 100 workers in 2018.

CRRC Sifang America Inc. is an American subsidiary of the Chinese rail firm CRRC. Its new $100 million facility on the Southeast Side of Chicago brought rail manufacturing back to the city for the first time in 50 years. After being awarded the contract to build 400 railcars for the Chicago Transit Authority in 2016, CRRC built the new factory between 2017-2019 and hired 170 employees from local electrical and transportation unions in Chicago. The new 7000 series railcars use Wabtec regenerative and hydraulic braking systems, and Siemens traction and safety systems. They started rolling out in 2021 on the Blue, Brown, and Orange Lines.

Opportunities Ahead

The IIJA was a bipartisan commitment to rebuild America’s crumbling transportation system, but it was also a commitment to America’s workers. It increased “a domestic content procurement preference” for infrastructure projects, including materials like iron, steel, construction materials, and manufactured products. Every new train car and mile of track creates jobs across the country.

Alstom rail manufacturing

As part of the IIJA, Congress designated $66 billion for passenger rail, including $22 billion directly to Amtrak, which will be partly used to replace rolling stock. The rest will be through competitive grants, administered by the Federal Railroad Administration. Given that every $1 invested in rail generates about $4 in economic returns, this will have profound ripple effects for years to come. Industry experts expect rail manufacturing to grow 4.7% per year from 2021 to 2026. These funds have already begun to roll out, rippling throughout the U.S. economy and the rail supply chain, in particular.

On the public transit side, route expansions underway include:

- Los Angeles – The Metro is working on another 22+ miles of train line expansions, including a subway and two light rail lines. CRRC Sifang America Inc. was awarded a contract for 64 cars in 2017, with the option for an additional 218. Hyundai Rotem USA was awarded a contract for 182 cars in 2023, with the option for 50 more.

- Miami, FL – TriRail’s Downtown Miami Link expansion could open by early 2024. Hitachi Rail Italy was awarded a contract for 136 cars in 2012, which began rolling out of the Florida Medley Plant in 2017.

- Minneapolis, MN – Southwest light rail project will add 14.5 miles and 16 stations to the Green Line by 2027. Siemens of Sacramento, CA was awarded a contract to build 27 light rail vehicles in 2016, with the option to purchase another 50.

- Seattle’s Sound Transit system is planning “the most ambitious transit expansion in the country” with a 116-mile network of 70 stations proposed by 2044. Siemens, Sacramento, CA awarded light rail vehicle contract in 2016 for 122 cars, extended to 152 in 2017.

- Louis, MO – 5.2mi Red Line extension began construction in 2023, operations expected in 2025. Metro St. Louis announced a new contract for 48 Siemens S200 high-floor light rail vehicles in 2023.

- Washington, DC – Purple line light rail opening 2026. Hitachi Rail was selected to build a base order of 256 rail cars at its new Washington County, MD factory, with the option for another 800 cars.

We can expect major expansions for intercity rail as well. In the Midwest, Amtrak is rolling out a second daily train between Minneapolis-St. Paul, Milwaukee, and Chicago in early 2024. The Great River train will complement existing Empire Builder Service, as an extension of the Hiawatha line that currently connects Chicago to Milwaukee. Out West, California’s High-Speed Rail line is coming along, with the initial 171-mile segment between Merced and Bakersfield anticipated in 2028. The Cascades line between Seattle and Portland will be launching two new round-trip trains in December 2023, bringing total service to 12 daily trains.

Down South, Amtrak is close to reopening service on the Gulf Coast Limited line between New Orleans, LA and Mobile, AL, after Hurricane Katrina took it out of commission in 2005. And Brightline’s Florida service should be expanding to Tampa next, tying to Orlando and Miami. The company has its sights set on the desert next, eyeing a new connection between Los Angeles and Las Vegas that it has dubbed Brightline West.

Conclusion

The transit and rail manufacturing supply chain in the United States is strong. There are companies in virtually every state and across the manufacturing value chain, and many large and small companies are growing rapidly year over year. This sector has only grown stronger in the years since our last supply chain report in 2015, and the bipartisan Infrastructure Investment and Jobs Act has amplified these trends. Each major infrastructure project awarded federal funds has ripple effects throughout the country, creating manufacturing jobs, improving mobility, and protecting the environment.

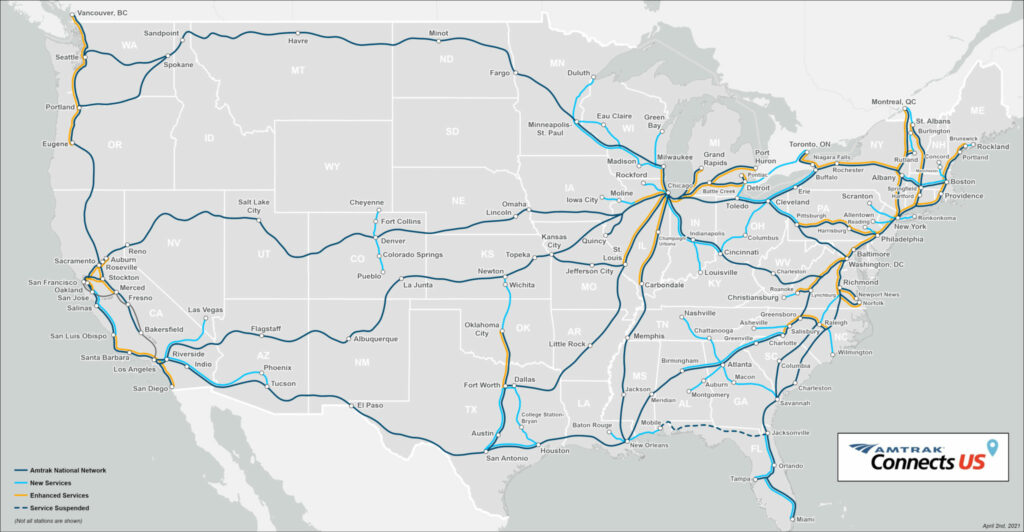

And the story is far from over. Amtrak plans to double ridership by 2040. Its new Amtrak Connects US plan would connect up to 160 communities with new and improved rail corridors in over 25 states over the next 15 years. It would increase rail service to 47 of the top 50 metropolitan areas and create over a half a million new jobs. In parallel, Congress has called on the Federal Railroad Administration to study restoring and expanding long-distance passenger rail service and identify capital projects and funding needed to implement that vision. And in late 2023, the Administration awarded grants to 69 projects across 44 states to study passenger rail expansion. While not every study will result in rail service, this long term commitment bodes well for the rail supply industry and its workers.

Amtrak Connects US plan of passenger rail routes being studied for expansion